The internet is facing a growing permissions crisis. As chatbots, AI agents, and automated systems rapidly multiply online, companies are struggling to manage their identities, credentials, and access rights. This shift has fueled a surge of venture capital into identity and access management startups building tools for what many now call the “digital workforce.”

One of the latest entrants is Venice, a 35 person Israeli American cybersecurity startup that has just emerged from stealth with $20 million in Series A funding. The round, raised in December, was led by IVP with participation from Index Ventures, which previously led the company’s seed round.

Venice is making an ambitious claim: it says it is already replacing established identity security giants such as CyberArk and Okta within Fortune 500 enterprises.

Tackling Hybrid Identity Complexity

Unlike many heavily funded competitors including Persona, Veza, and GitGuardian, Venice is building a platform designed to operate across both cloud based and on premises environments.

That technical decision has made the product more difficult to build, but it also positions Venice to serve large enterprises that still rely on legacy infrastructure alongside modern cloud systems. For many Fortune 500 companies, hybrid IT environments are the norm, not the exception.

Founder With Deep Cybersecurity Roots

Venice is led by 31 year old Rotem Lurie, whose background spans elite intelligence and enterprise cybersecurity.

Lurie served for four and a half years as a lieutenant in Unit 8200, Israel’s elite intelligence corps, before joining Microsoft as a product manager. There, she worked on what would become Defender for Identity.

She later became the first product hire at Axis Security, an access management startup acquired by Hewlett Packard Enterprise for $500 million in 2022. Shortly before the deal closed, Lurie joined YL Ventures, a cybersecurity focused venture firm, where she gained insight into how many startups are built primarily for acquisition rather than long term category leadership.

That experience shaped her strategy for Venice. Instead of targeting a narrow niche, the company is aiming to replace incumbent platforms outright by delivering a deeper, more unified solution.

Consolidating Identity Tools Into One Platform

Most enterprise identity teams currently juggle around ten different tools to manage access controls across servers, SaaS applications, and cloud infrastructure.

Venice’s platform consolidates that complexity into a single system that handles privileged access management for both human users and non-human entities, including AI agents. The company operates on a SaaS subscription model but emphasizes that cost reduction comes from eliminating overhead rather than discount pricing.

According to Lurie, Venice reduces the heavy consulting fees and prolonged implementations that typically accompany enterprise security deployments. Traditional rollouts can take anywhere from six months to two years. Venice claims its AI powered automation reduces implementation time to roughly one and a half weeks.

The company says it is now fully replacing legacy vendors at Fortune 500 and Fortune 1000 companies. While specific customers were not publicly disclosed, Venice reportedly counts a 170 year old publicly traded manufacturing company and a global music conglomerate among its clients.

Why Investors Are Betting Big

Cack Wilhelm, the IVP partner who led the Series A investment, believes Venice is targeting a problem large enough to reshape enterprise cybersecurity.

He argues that as AI agents increasingly act on behalf of individuals and organizations, traditional identity frameworks built for static IT teams are becoming obsolete. In many major breaches, attackers gain access by logging in with stolen credentials. Just in time permissions, scoped precisely to the user and moment, are emerging as a critical defense.

The broader market opportunity is significant. Identity and access management spending was projected to surpass $24 billion in 2025, representing a 13 percent year over year increase, according to industry estimates.

Building A Diverse Cybersecurity Team

Venice operates with its research and development team based in Israel and its go to market team in North America. Notably, nearly half of the company’s workforce is women, an uncommon statistic in the traditionally male dominated cybersecurity sector.

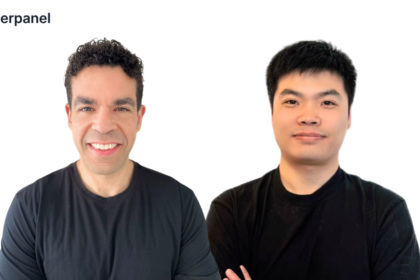

Lurie co-founded Venice with Or Vaknin, who serves as CTO. The company’s investors also include Assaf Rappaport, co-founder and CEO of Wiz, and Raaz Herzberg, CMO at Wiz and a former Microsoft colleague of Lurie.

Read Also: Coupang Confirms Massive Data Breach Affecting 34 Million Users

For Lurie, building a balanced team was less about strategy and more about representation. She has frequently been the only woman in the room throughout her career and believes visibility plays a powerful role in attracting more women into cybersecurity leadership.

The Road Ahead

The identity and access management market is crowded and competitive. Deep pocketed rivals are racing to modernize platforms for an AI driven world. The question now is whether Venice’s early Fortune 500 wins and two year head start will be enough to maintain momentum.

As enterprises rethink identity in an era of autonomous agents and hybrid infrastructure, Venice is betting that consolidation, automation, and speed will define the next phase of cybersecurity.

Whether the market consolidates around a few dominant players or supports multiple leaders remains to be seen. But one thing is clear: managing identities for both humans and machines has become one of the most urgent challenges of the AI age.