Nuclear startup Deep Fission announced Monday that it has gone public through a reverse merger, securing $30 million in funding.

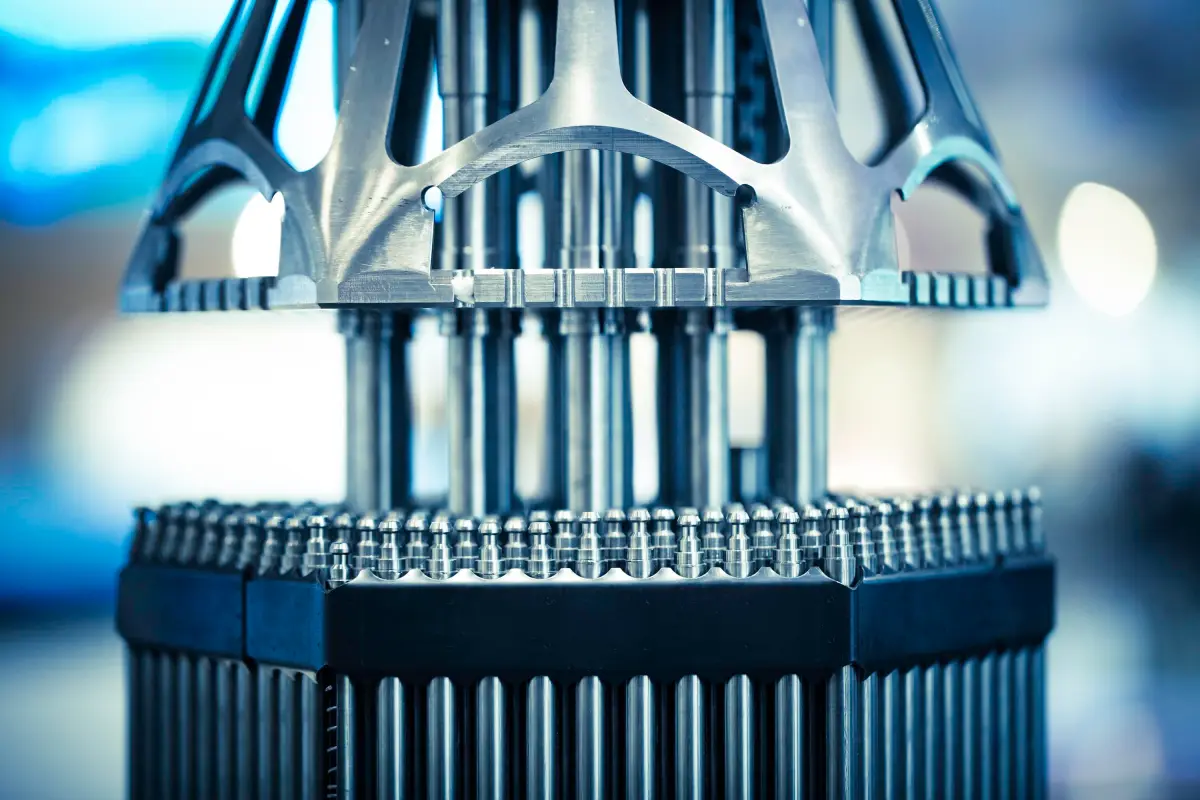

The company’s pitch is bold: build compact, cylindrical 15-megawatt nuclear reactors, then lower them a mile underground into 30-inch-wide boreholes. By burying reactors, Deep Fission hopes to reduce risks associated with meltdowns and terrorist attacks while offering safer, more distributed nuclear power.

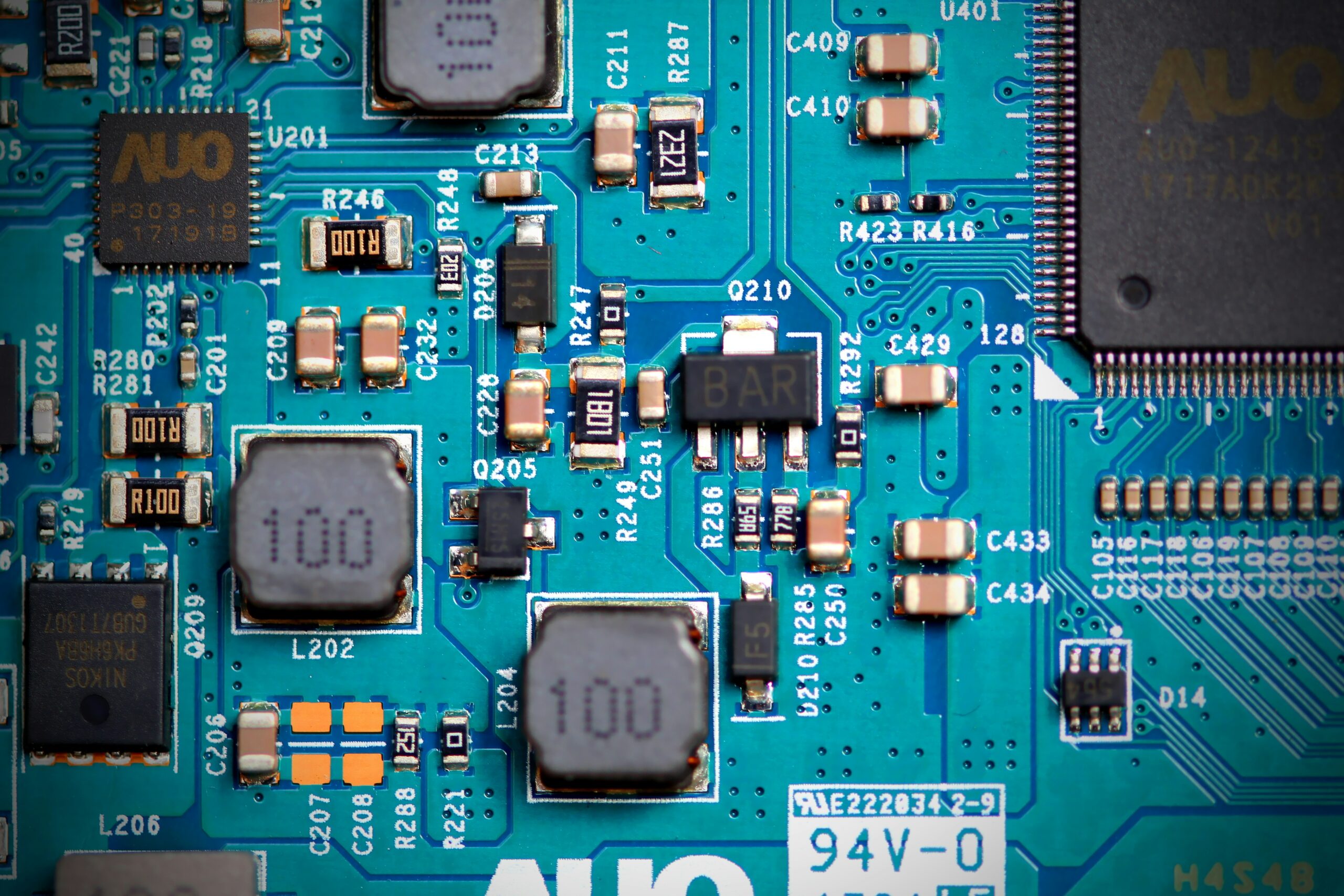

The reactors use pressurized water cooling, a proven system found in submarines and many existing nuclear plants. Earlier this year, Deep Fission struck a deal with Endeavor, a data center developer, to provide up to 2 gigawatts of underground nuclear capacity.

The startup has been on a rapid trajectory. In April, it was seeking a $15 million seed round. By August, it was among 10 companies selected for the Department of Energy’s Reactor Pilot Program, which streamlines the permitting process for advanced fission projects.

Its public debut came through a merger with Surfside Acquisition Inc., a four-year-old SPAC. The deal was priced at $3 per share, well below the $10 norm for most SPACs, and the combined entity will continue under the Deep Fission name. Shares are not yet trading, but the company plans to list on the OTCQB market.

Related: Uber Drops $300M on Lucid and Nuro to Launch 20,000 Robotaxis Tech Happened

The deal structure suggests Deep Fission faced challenges raising money from investors after its initial $4 million funding last year. Still, the reverse merger provides more cash than its seed round would have delivered, though it also brings higher costs as the company takes on SEC reporting requirements.

Deep Fission aims to deploy its first underground reactor by July 2026.